PLUS: Builder Homebuyer Incentives Still Strong

|

Hey Basis Pointers, if you missed America's most influential fintech conference last week, Robyn's got you covered with our Fintech Nexus USA 2023 Live Blog.

The state of fintech is strong despite the tough market cycle, and Robyn's live blog is a great way to get up to speed fast.

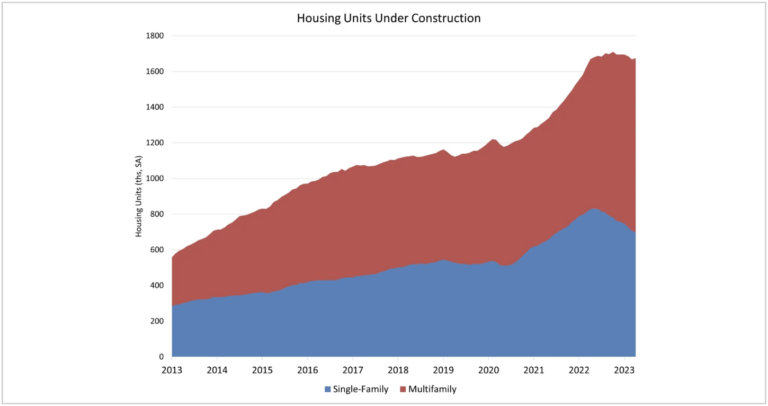

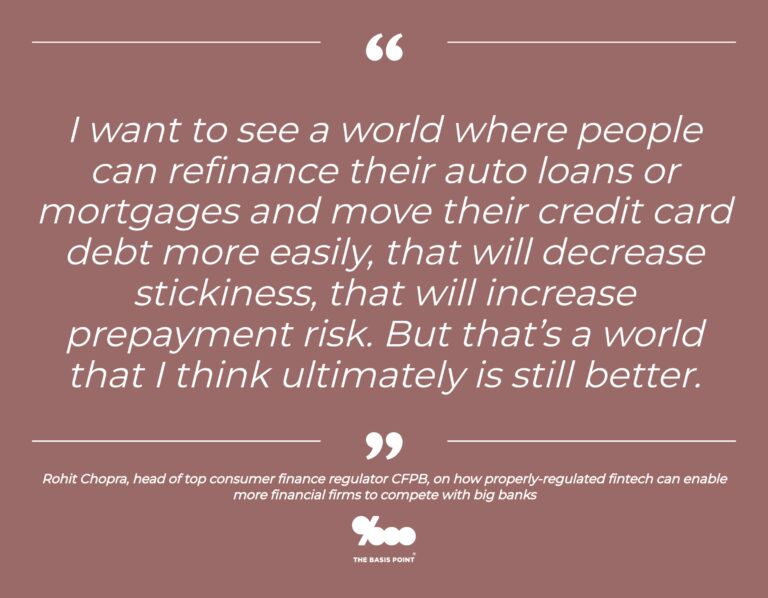

On a related note, see links below to what America's top consumer finance regulator (CFPB director Rohit Chopra) thinks of fintech and what one of the top fintech banking apps (Chime, run by Chris Britt) thinks Americans need most in banking.

Both of these leaders, and so many more, are covered in our Fintech Nexus Live Blog.

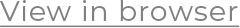

In housing, builder data this week shows 33% of homes listed for sale are in various stages of construction. This is way above the 2000-2019 norm of 12.7%, and a nice inventory offset to private sellers still reluctant to list existing homes.

Builder incentives remain strong. Here are latest stats on builder price reductions and details on 1.68m houses and apartments currently under construction.

In tomorrow's newsletter, we'll update our home affordability calculations using today's April existing home sales, which showed median prices of $388,800.

Julian

The state of fintech is strong despite the tough market cycle, and Robyn's live blog is a great way to get up to speed fast.

On a related note, see links below to what America's top consumer finance regulator (CFPB director Rohit Chopra) thinks of fintech and what one of the top fintech banking apps (Chime, run by Chris Britt) thinks Americans need most in banking.

Both of these leaders, and so many more, are covered in our Fintech Nexus Live Blog.

In housing, builder data this week shows 33% of homes listed for sale are in various stages of construction. This is way above the 2000-2019 norm of 12.7%, and a nice inventory offset to private sellers still reluctant to list existing homes.

Builder incentives remain strong. Here are latest stats on builder price reductions and details on 1.68m houses and apartments currently under construction.

In tomorrow's newsletter, we'll update our home affordability calculations using today's April existing home sales, which showed median prices of $388,800.

Julian

27% of homebuilders reduced prices and 54% offered buyer incentives in May

Key notes from NAHB on homebuilder confidence, how builders are making deals with buyers right now, and how many homes are getting built.

/ Read More

/ Read More

LIVE BLOG: Day 2 of Fintech Nexus USA 2023 NYC - In a Fintech State of Mind

Fintech Nexus USA 2023 comes as fintech and banking is retrenching, and the innovation energy was palpable. Here's The Basis Point live blog (Day 2 of 2).

/ Read More

/ Read More

LIVE BLOG: Day 1 of Fintech Nexus USA 2023 NYC - In a Fintech State of Mind

Fintech Nexus USA 2023 comes as fintech and banking is retrenching, and the innovation energy was palpable. Here's The Basis Point live blog (Day 1 of 2).

/ Read More

/ Read More

Top consumer finance regulator Rohit Chopra actually sounds fintech friendly here

I want to see a world where people can refinance their auto loans or mortgages and move their credit card debt more easily, that will decrease stickiness, that will increase prepayment risk. But that’s a world that I think ultimately is still better.

/ Read More

/ Read More

Digital bank app CEO Chris Britt on niche Chime serves, how they make money, why Americans don't trust banks

Big banks do a pretty good job with high income, high FICO score folks who have big deposits and are credit worthy, but for most Americans, the 65% that live paycheck to paycheck, the only way that big banks can make the math work on serving them is by being very punitive on fees.

/ Read More

/ Read More

Did you get this email forwarded or via social?

Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States