PLUS: Terrifying Car Patent, Regional bank health check

|

Good morning Basis Pointers, hope your week is going great. ? ?

Today I make key Points about new Federal mortgage fees. Not to add noise, but to correct blatant fee vs. rate errors. Almost everyone is wrong on these nuances, and only one source is right in the end. Period.

Robyn also has a hilarious/terrifying piece about a new Ford auto-repossession patent. She and Dennis don't just have artwork you see below, there's more in this piece about the dark side of smart cars and homes.

And two more quick hits:

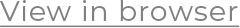

(1) Friend of TBP and renowned NYC appraiser Jonathan Miller updates his annual intel on how much Wall Street bonuses impact NYC housing.

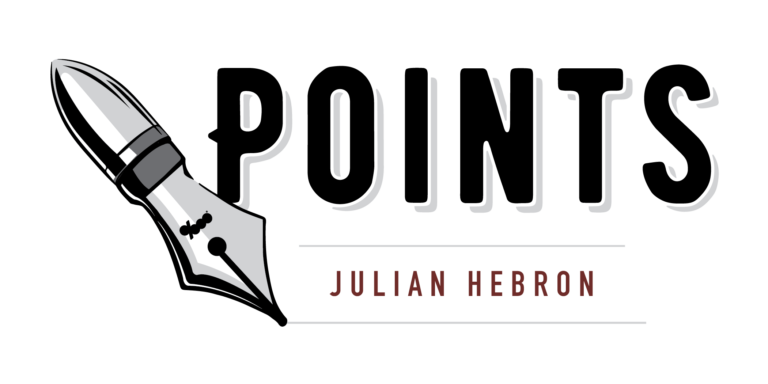

(2) Reuters has a great regional bank health check, with 4Q to 1Q deposit losses for 15 banks all in one chart.

Enjoy the day, and please keep your intel coming. We got lots of smart notes on our state of jumbo mortgage post yesterday. Will do a follow up on that soon.

Julian

Today I make key Points about new Federal mortgage fees. Not to add noise, but to correct blatant fee vs. rate errors. Almost everyone is wrong on these nuances, and only one source is right in the end. Period.

Robyn also has a hilarious/terrifying piece about a new Ford auto-repossession patent. She and Dennis don't just have artwork you see below, there's more in this piece about the dark side of smart cars and homes.

And two more quick hits:

(1) Friend of TBP and renowned NYC appraiser Jonathan Miller updates his annual intel on how much Wall Street bonuses impact NYC housing.

(2) Reuters has a great regional bank health check, with 4Q to 1Q deposit losses for 15 banks all in one chart.

Enjoy the day, and please keep your intel coming. We got lots of smart notes on our state of jumbo mortgage post yesterday. Will do a follow up on that soon.

Julian

Wall Street bonuses down 26% to $176k. Does this hurt NYC home buying?

Renowned NYC real estate appraiser Jonathan Miller just updated his chart set on 2022 Wall Street bonuses. He notes why NYC housing may be less reliant on Wall Street jobs than it used to.

/ Read More

/ Read More

WTF! Ford repossession patent makes 'smart' cars lock you out for late payments?

Bleak future of smart cars (and homes): Ford repossession patent to lock customers out of car, kill AC, or drive away for missed payments.

/ Read More

/ Read More

Almost Everyone Is Wrong About New Federal Mortgage Fee Changes

WSJ wrongly claims rates rise by 3x more than they actually do with new May 1 Federal mortgage fee changes. Here's why they got it wrong. And more important, here's the only source borrowers can trust on this topic.

/ Read More

/ Read More

How much in deposits did 15 biggest regional banks lose from 4Q22 to 1Q23? (TABLE)

Deposit losses from 15 largest regional banks from 4Q to 1Q show First Republic and Schwab were worst. Rest reasonably contained.

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States