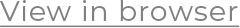

Today JPMorgan Chase bought First Republic from the FDIC after the bank was closed by the California Department of Financial Protection and Innovation, which appointed FDIC as receiver. Below are key details of the deal from FDIC and JP Morgan Chase.

NOTES FOR FIRST REPUBLIC CUSTOMERS

– JPMorgan Chase will protect all deposits, regardless of whether they’re above or below the FDIC’s $250,000 insured limit.

– First Republic’s 84 offices in 8 states will open today as normal.

– All depositors of First Republic Bank will become depositors of JPMorgan Chase, and will have full access to all of their deposits.

– Deposits will continue to be insured by the FDIC, and customers do not need to change their banking relationship in order to retain their deposit insurance coverage up to applicable limits.

– Customers of First Republic should continue to use their existing branch until they receive notice from JPMorgan Chase that it has completed systems changes to allow other JPMorgan Chase Bank branches to process their accounts as well.

– JPMorgan Chase CEO Jamie Dimon said this morning they won’t keep the First Republic brand name.

WHAT JPM IS BUYING

– As of April 13, 2023, First Republic Bank had approximately $229.1 billion in total assets and $103.9 billion in total deposits.

– JPMorgan Chase will buy a substantial majority of assets and deposits, including $173b of loans, $30b of securities, and $92b in deposits.

-This includes $30b in deposits that JPM and 11 banks put in (details on each of 11 banks’ contributions here) during a relief effort in March.

– FDIC will provide loss share agreements covering acquired single-family residential mortgage and commercial loans, as well as $50 billion of 5-year, fixed-rate term financing.

– It appears that First Republic shareholders are wiped out. JPM says its not assuming First Republic corporate debt or preferred stock.

HIT TO FDIC

– With $229b in assets, First Republic’s failure is the second largest bank failure in U.S. history.

– The biggest was WAMU in 2008 ($307b assets when failed), which was also sold to JPM Chase.

– The 3rd and 4th ranked biggest failures in U.S. history are Silicon Valley Bank ($209b assets when failed) and Signature Bank ($118b when failed), which were sold to First Citizens and NYCB’s Flagstar unit.

– The FDIC estimates that the cost to the Deposit Insurance Fund will be about $13 billion.

– During the bidding process, FDIC asked acquiring banks to submit their plan for replenishing the FDIC deposit insurance fund, which took a $20b hit on the SVB bank failure in March.

– JPMorgan will make a $10.6 billion payment to the FDIC and estimated it will incur $2 billion in related restructuring costs over the next 18 months.

– JPMorgan says it will recognize a one-time gain of $2.6 billion tied to the transaction.

___

Reference: