PLUS: Apple Bank Seeds Growing Fast

|

Good morning Basis Pointers. This weekend imminent FDIC seizure and/or brokered sale of First Republic Bank to a bigger bank is likely. This leaves 3 huge questions:

(1) Will PNC Financial, JP Morgan Chase, or 1 of the other 9 banks that invested $30b to save First Republic now buy it?

(2) How bad will the FDIC insurance fund suffer?

(3) Will the loved First Republic brand get retained?

Here are the answers.

And here are 3 other Saturday morning fintech, banking, housing reads:

Apple's bank seeds are growing fast.

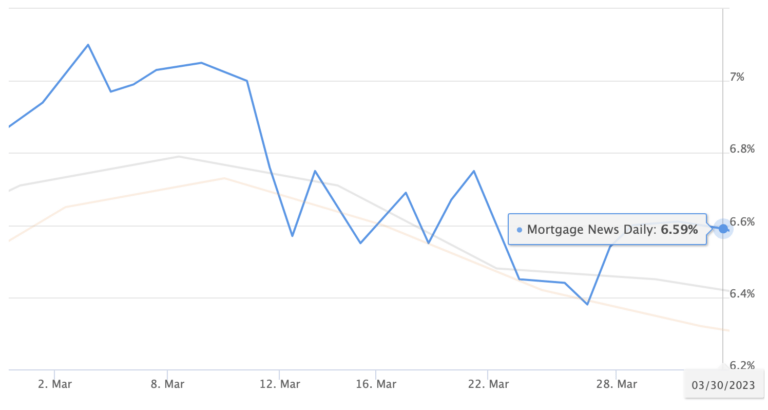

How much did March bank crisis hurt new home sales?

And, here's what you need to earn to buy a new home right now.

Enjoy the day, and please keep reaching out with your intel on these topics...

Julian

(1) Will PNC Financial, JP Morgan Chase, or 1 of the other 9 banks that invested $30b to save First Republic now buy it?

(2) How bad will the FDIC insurance fund suffer?

(3) Will the loved First Republic brand get retained?

Here are the answers.

And here are 3 other Saturday morning fintech, banking, housing reads:

Apple's bank seeds are growing fast.

How much did March bank crisis hurt new home sales?

And, here's what you need to earn to buy a new home right now.

Enjoy the day, and please keep reaching out with your intel on these topics...

Julian

What would FDIC lose in First Republic seizure, sale to PNC or JP Morgan Chase?

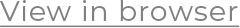

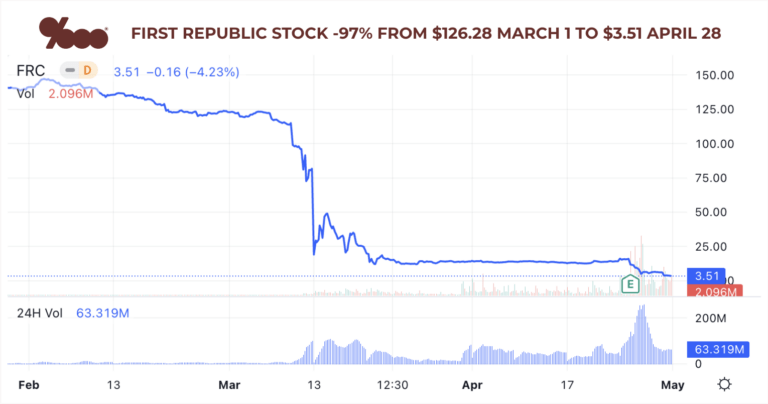

First Republic FDIC seizure imminent. If PNC, Chase, or another of the 11 banks who initially deposited $30b buy it, what's the FDIC hit?

/ Read More

/ Read More

First Republic FDIC seizure imminent: REUTERS

First Republic is out of time for a private deal, Reuters reports. FDIC is reportedly preparing to seize First Republic. FDIC would subsequently sell First Republic.

/ Read More

/ Read More

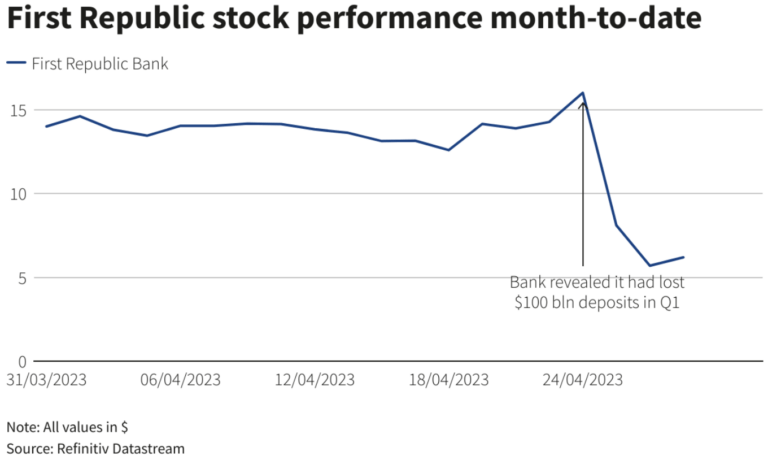

APPLE SEEDS: 29% of U.S. adults & 69% of Apple Card users likely to open Apple savings next 6mo

Good Start For Apple Savings: Gen Z and millennials especially interested in Apple savings account, but generally all adults, especially Apple Card owners also interested.

/ Read More

/ Read More

Bank crisis impact on new March home deals & NAR home price predictions 2023 & 2024

March 2023 pending home sales drop on low inventory, new home competition, and probably bank crisis worry. Here's home price predictions too.

/ Read More

/ Read More

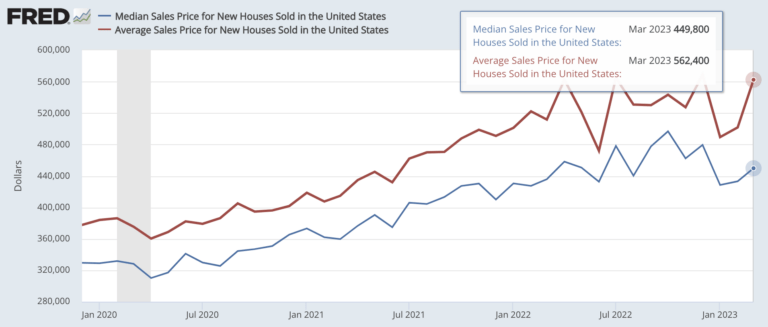

Newly built home prices $449,800 in March 2023. Can you afford this?

New home prices of $449,800 are up $11k from Feb but down $47k from peak. Can you afford this? You need to make $99k-117k/yr to qualify. Here's the math.

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States