PLUS: Rates vs. home prices, Saving bank brands

|

BEWARE INFLUENCER 2.0, SAVE THIS BANK BRAND

Taking a break from bank chaos coverage to await Fed rate policy decision later today. But we do have one quick hit on how rare it is for people to truly love a bank brand. That's why First Republic is getting big bank and regulator help.

Meanwhile on social media, do you cringe at all things "influencer"?

Then you're going to love the new trend: "Deinfluencing." But while we cringe, the industry grew by $15 billion since 2006. So you need to know what's up, and we've got a funny piece to help -- complete with a good rip on your annoying colleagues!

And one more piece this morning on how Fed moves hit homebuyers.

Enjoy the day, and check the site later for updates on today's critical Fed meeting :)

Julian

Meanwhile on social media, do you cringe at all things "influencer"?

Then you're going to love the new trend: "Deinfluencing." But while we cringe, the industry grew by $15 billion since 2006. So you need to know what's up, and we've got a funny piece to help -- complete with a good rip on your annoying colleagues!

And one more piece this morning on how Fed moves hit homebuyers.

Enjoy the day, and check the site later for updates on today's critical Fed meeting :)

Julian

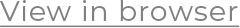

Homes at $363k affordable even with what Fed is doing to rates

USA Today has a good series of charts and experts commenting on Fed actions and their impact on home buying and selling.

/ Read More

/ Read More

Influencer market grew $14.7b 2016-2022, but new TikTok craze is ‘Deinfluencing’. Seriously?!

Can’t stand influencers? Then you’re going to love latest TikTok craze: Deinfluencers! Deinfluencing is like, totally authentic.

/ Read More

/ Read More

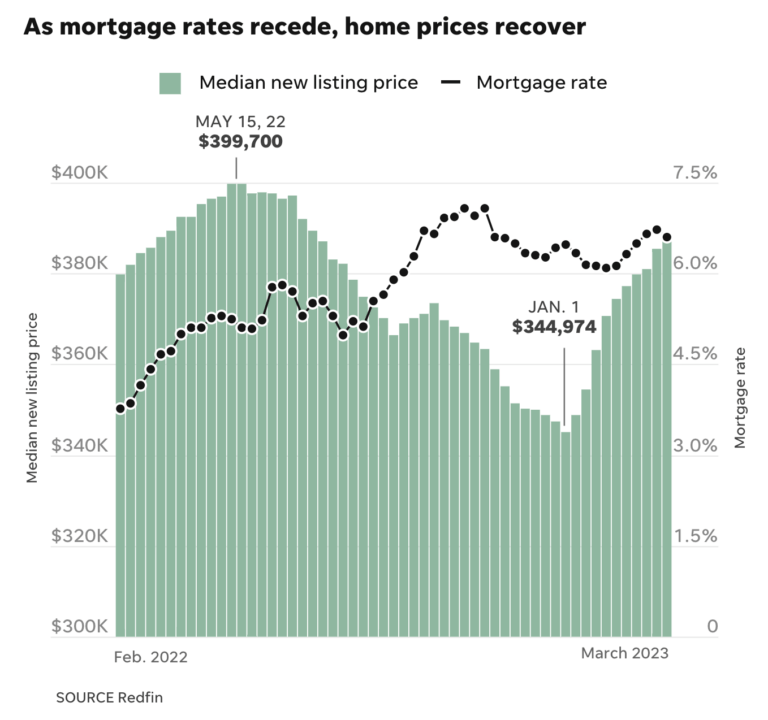

In a First Republic sale scenario, I hope this valuable bank brand would stay

First Republic sale among options bank exploring with JP Morgan, Lazard, McKinsey (per WSJ). If so, I hope brand stays. Local banks matter. Just like our Treasury Secretary said today.

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States