U.S. bank strain resumes post UBS-Credit Suisse rescue

|

GOV'T & BANKS RACE TO CALM NERVES

Happy Monday to all you Basis Pointers, although bank unhappiness continues even after $3.25 billion shotgun wedding between UBS and Credit Suisse last night.

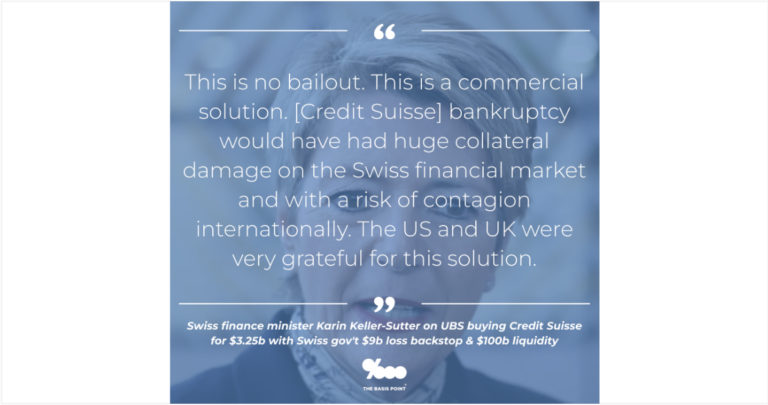

Credit Suisse is one of the 30 most systemically important banks, so the Swiss government provided UBS with a $9.7 billion loss backstop and $108 billion in liquidity to get this deal done.

Then U.S. markets opened, and First Republic stock resumed last week's 72% slide. Wall Street started talking about a First Republic sale Friday, and since 11 banks worked with Treasury, Fed, FDIC, and OCC to deposit $30 billion to backstop First Republic already, a government brokered deal here seems possible.

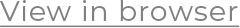

We discuss that in a piece below. And after Swiss finance minister said "This is no bailout," we also address this debate when government helps in these crises.

What's your take? Please reply or comment on the posts.

Credit Suisse is one of the 30 most systemically important banks, so the Swiss government provided UBS with a $9.7 billion loss backstop and $108 billion in liquidity to get this deal done.

Then U.S. markets opened, and First Republic stock resumed last week's 72% slide. Wall Street started talking about a First Republic sale Friday, and since 11 banks worked with Treasury, Fed, FDIC, and OCC to deposit $30 billion to backstop First Republic already, a government brokered deal here seems possible.

We discuss that in a piece below. And after Swiss finance minister said "This is no bailout," we also address this debate when government helps in these crises.

What's your take? Please reply or comment on the posts.

'The Fed knows what it's doing' and it gets its role as lender of last resort

The Fed is in triage mode. Inflation is a problem and Fed won't forget that. But keeping financial system out of a tailspin is the top priority.

/ Read More

/ Read More

Will U.S. regulators broker a First Republic sale like Swiss did with Credit Suisse?

Will U.S. gov't broker a First Republic sale like Swiss did with Credit Suisse? FDIC has already sold 1 of 2 failed regional banks (Signature), and gov't already helped 11 big banks backstop First Republic.

/ Read More

/ Read More

UBS buying Credit Suisse for $3.25b with Swiss help 'is no bailout'

Does UBS buying Credit Suisse with Swiss help stem banking crisis contagion or is it a Karin Keller Sutter bailout? Debate begins.

/ Read More

/ Read More

If Credit Suisse rejects ‘up to $1b’ UBS offer, Switzerland may take it over

To contain panic after 2nd & 3rd largest U.S. bank failures ever, authorities race to rescue Credit Suisse, among world's largest wealth managers and considered by regulators to be 1 of 30 systemically important banks

/ Read More

/ Read More

Of course techy libertarians expect government to cover their SVB losses

Lots of tech leaders mock colleges as ‘woke madrassas’ & call student-loan forgiveness moral hazard. But when their money’s at risk, they're all for privatizing profits and socializing losses.

/ Read More

/ Read More

What UBS Wants If It Takes Over Credit Suisse - via FT

UBS market cap ($56.6b) & 2022 profit ($7.6b) vs. Credit Suisse $8b market cap & 2022 loss (-$7.9b) make a rival rescue tempting. But UBS wants many assurances.

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States