PLUS: The Big Short guy's take on what's next

|

INFLATION HOT, BANK PANIC COOLS

Thanks to all you Basis Pointers who've signed up for our newsletter! We truly appreciate your support, and we’ll now go daily at 9am PT/12pm ET with useful, quick, creative intel on housing, fintech, banking, media, marketing, pop culture, and some politics (about money, homes, tech). We’ll also sparingly send you market and deal news when it breaks.

With the banking crisis playing out, we're going heavier than normal (hence all the stories below), but there should be something for everyone as you scroll.

We love hearing from you, so keep your replies coming -- we incorporate your notes into our content and our thinking even if we don't reply right away. On a related note, we do monitor and reply to comments on site posts and on our LinkedIn page (which we hope you follow here!).

Have a great day, and let's hope this bank crisis keeps cooling off like it is today.

With the banking crisis playing out, we're going heavier than normal (hence all the stories below), but there should be something for everyone as you scroll.

We love hearing from you, so keep your replies coming -- we incorporate your notes into our content and our thinking even if we don't reply right away. On a related note, we do monitor and reply to comments on site posts and on our LinkedIn page (which we hope you follow here!).

Have a great day, and let's hope this bank crisis keeps cooling off like it is today.

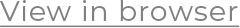

Will Fed hike again March 22 after Feb CPI inflation stays high and bank crisis calms?

Mortgage rates down even on persistent February inflation as bond investors bet Fed will hike but banking crisis not over just yet.

/ Read More

/ Read More

Michael Burry of The Big Short fame tweets 2023 bank crisis 'could resolve very quickly'

Michael Burry tweet says "This crisis could resolve very quickly. I am not seeing true danger here." Let's hope he's right.

/ Read More

/ Read More

First Republic up 50%, leading regional bank relief rally

First Republic pre-market Tuesday trading was 40% as fears of an SVB-like bank run wane for now on the San Francisco bank.

/ Read More

/ Read More

Why Tim Mayopoulos is a strong FDIC choice for Silicon Valley Bank’s new CEO

FDIC named Mayopoulos to oversee a newly created SVB bridge bank operating under a board appointed by the FDIC to assume deposits and certain liabilities of the failed bank.

/ Read More

/ Read More

Bond king Jeff Gundlach predicts Fed hike March 22, says why recession could be in 'a few months'

In all the past recessions going back for decades, the yield curve starts de-inverting a few months before the recession comes in.

/ Read More

/ Read More

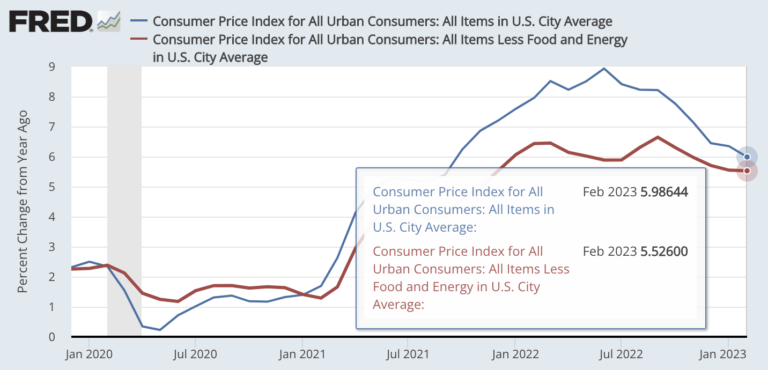

Banks Fail A Lot: 565 banks failed 2000-2023, and only 55% of deposits are insured

In 2008 $250k of FDIC insurance covered 80% of deposits, today it only covers 55%, and uninsured deposits grew $2.2t in last 3yrs alone.

/ Read More

/ Read More

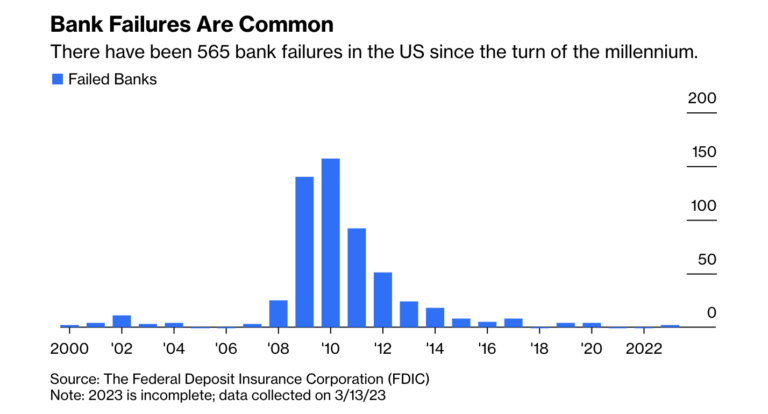

'Goliath Is Winning' - Wells Fargo bank analyst Mike Mayo upgrades JP Morgan Chase stock

A big bank analyst at Wells Fargo upgraded his stock rating of JP Morgan Chase. A fairly obvious sentiment at this time, but still one worth sharing. Goliath Is Winning in banking.

/ Read More

/ Read More

First Republic told CNBC on Mon, March 13 'it's business as usual' - here's the video

CNBC's Jim Cramer talked to First Republic executive chairman Jim Herbert, and said they're not seeing massive outflows and the business was operating as usual. Here's CNBC report and reaction.

/ Read More

/ Read More

Biden says bank deposits are safe for all Americans: VIDEO

Here's the full video of Biden talking Monday, March 13 about the banking crisis triggered by Silicon Valley Bank's demise. Biden says bank deposits are safe for everyone.

/ Read More

/ Read More

10 things we still don't know about the Silicon Valley Bank unraveling

Barry Ritholtz points out that all crises reveal lots of information about impacted firms and sectors long after the crisis events. Here are key questions about SVB we don't know yet.

/ Read More

/ Read More

Does the Fed's 2% inflation target even matter?

As the Fed raises rates to bring us back to 2% inflation, is this long-held “rule of economics” even relevant? Here's a case for ditching this inflation target.

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States