PLUS: Yellen on bailout vs. protecting consumers

|

GOV'T STEMS BANKING CRISIS

Today's handpicked stories below. We love hearing from you, so keep the replies coming -- we incorporate your notes into our content and our thinking.

Will there be a First Republic Bank run? Here are risk factors and strengths.

Will there be a First Republic bank run after Silicon Valley bank run? Here are some strengths and weaknesses of First Republic.

/ Read More

/ Read More

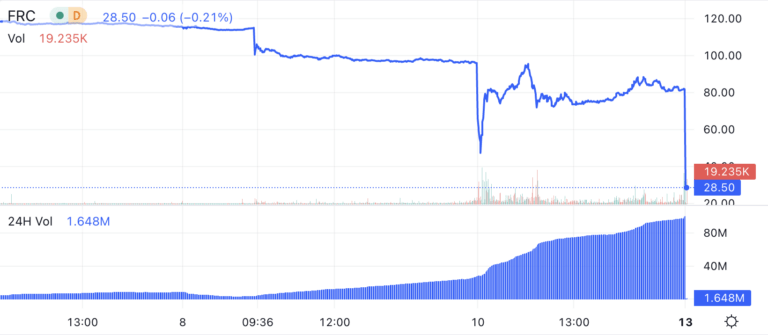

SVB Contagion Alert: First Republic drops 60%. Read this First Republic bank run briefing.

First Republic Bank led a decline in bank shares Monday that came even after regulators' extraordinary actions Sunday evening.

/ Read More

/ Read More

Banks will now have tougher time fighting off tighter capital rules

Banks believe Fed may press ahead with tougher rules that it was just beginning to discuss before SVB's meltdown

/ Read More

/ Read More

Goldman Sachs Predicts March 22 Fed Hike Off The Table

Read Goldman Sachs on Fed's bank backstop plan and how these events cause Goldman to remove their outlook for 25 basis point Fed hike March 22.

/ Read More

/ Read More

Biden on banking crisis: "I am firmly committed to holding those responsible for this mess fully accountable"

Biden issues statement on banking crisis, and says more is coming on Monday. Here's what he said on Sunday evening.

/ Read More

/ Read More

Read Fed plan to help resolve Silicon Valley Bank situation in way that "fully protects all depositors, both insured and uninsured"

Fed just approved protection for all SVB depositors, both insured and uninsured, saying "these actions will reduce stress across the financial system, support financial stability and minimize any impact on businesses, households, taxpayers, and the broader economy."

/ Read More

/ Read More

Treasury, Fed, FDIC statement says no losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer

Treasury, Federal Reserve, and FDIC jointly announced some details Sunday, March 12 about handling SVB and Signature Bank. Here is the letter in full.

/ Read More

/ Read More

Bipartisan Congress members suggest FDIC raise deposit insurance above $250k

On March 12, bipartisan Congress members made 5 key requests to protect depositors in wake of SVB collapse. This includes raising FDIC insurance. Read their full letter.

/ Read More

/ Read More

'Material action' expected Sun from Treasury, FDIC to stem SVB fallout, derisk jobs & payrolls for 220k workers

3500 tech firms representing 220k workers signed a petition for Treasury to backstop SVB depositors. A policy response is expected Sunday, March 12. Here's what we know so far.

/ Read More

/ Read More

Read exactly what Treasury chief Janet Yellen said about Silicon Valley Bank fallout & helping depositors

Here is a transcript of an interview with Treasury Secretary Janet Yellen on CBS with Margaret Brennan about plans after Silicon Valley bank failure

/ Read More

/ Read More

Did you get this email forwarded or via social? Subscribe Here

Unsubscribe

The Basis Point, 1963 McAllister St, San Francisco, California 94115, United States